- Home

- About Us

-

Hotel Furniture

- Contract Furniture

- AC Hotel Furniture

- Aloft Hotel Furniture

- AmericInn & Suites Furniture

- Andaz Hyatt Hotel Furniture

- Autograph Collection Hotel Furniture

- Avid Hotel Furniture

- Baymont Inn & Suites Furniture

- Best Western Hotel Furniture

- Candlewood Suites Furniture

- Canopy by Hilton Furniture

- Clarion Hotel Furniture

- Clarion Inn Furniture

- Comfort Inn & Suites Rise & Shine™ Furniture

- Conrad Hotel Furniture

- Country Inn & Suites Furniture

- Courtyard by Marriott Furniture

- Crowne Plaza Hotel Furniture

- Curio Collection By Hilton Hotel Furniture

- Days Inn Furniture

- Delta Hotel By Marriott Furniture

- DoubleTree by Hilton Hotel Furniture

- Econo Lodge Furniture

- Edition Hotel Furniture

- Element By Westin Furniture

- Embassy Suites by Hilton Furniture

- EVEN Hotels By IHG Furniture

- Fairfield Inn & Suites Furniture

- Fairmont Hotel Furniture

- Four Points By Sheraton Furniture

- Gaylord Hotel By Marriott Furniture

- Grand Hyatt Hotel Furniture

- Grand Mercure Hotel Furniture

- Hampton Inn Furniture

- Hilton Garden Inn Furniture

- Holiday Inn Express Furniture

- Holiday Inn Furniture

- Home2 Suites Furniture

- Homewood Suites Furniture

- Hotel Indigo Furniture

- Hyatt Centric Furniture

- Hyatt Hotel Furniture

- Hyatt House Hotel Furniture

- Hyatt Place Furniture

- Hyatt Regency Furniture

- Ibis Hotel Furniture

- Jumeirah Furniture

- JW Marriott Furniture

- La Quinta Inn & Suites Furniture

- Le Meridien Hotel Furniture

- Mainstay Suites Furniture

- Mercure Hotel Furniture

- Microtel Inn & Suites Furniture

- Motel 6 & Studio 6 Furniture

- Motto by Hilton Furniture

- Movenpick Hotel Furniture

- Novotel Hotel Furniture

- Park Hyatt Furniture

- Park Inn by Radisson Furniture

- Premier Inn Hotel Furniture

- Pullman Hotel Furniture

- Quality Inn & Suites Furniture

- Radisson Blu Furniture

- Radisson Park Plaza Furniture

- Raffles Hotel Furniture

- Ramada Hotel Furniture

- Red Roof Inn Furniture

- Renaissance Hotel Furniture

- Residence Inn Furniture

- Ritz Carlton Hotel Furniture

- Rodeway Inn & Suites Furniture

- Sheraton Hotel Furniture

- Sleep Inn Furniture

- Howard Johnson Hotel Furniture

- Sofitel Hotel Furniture

- SpringHill Suites Furniture

- St Regis Hotel Furniture

- Staybridge Suites Furniture

- Super 8 Furniture

- Swissotel Furniture

- Travelodge Inn & Suites Furniture

- Tribute Portfolio Hotel Furniture

- Tru by Hilton Furniture

- W Hotels Marriott Furniture

- Waldorf Astoria Furniture

- Westin Hotels & Resorts Furniture

- Wingate by Wyndham Furniture

- WoodSpring Suites Furniture

- Wyndham Garden Furniture

- Budget Hotel Furniture

- Accommodation Furniture

- Restaurant Furniture

-

Blog

- WHAT IS HOSPITALITY FURNITURE

- What Is Hospitality Interior Design?

- What is FF&E?

- What is FF&E and OS&E?

- 18 Hilton Hotel Brands

- Your Guide to Hilton Honors Hotel Brands

- All 18 Hilton Hotel Brands Explained & Prices Compared

- An In-Depth Guide to All 18 Hilton Hotel Brands

- 14 Choice Hotel Brands

- 18 Best Western Hotel Brands

- 23 Wyndham Hotel Brands

- 19 Hyatt Hotel Brands

- What Are IHG Hotel Brands?

- 16 IHG Hotels & Resorts Brands

- Hotel Brands: Marriott, Hyatt, Hilton, IHG (Who Owns What?)

- What are Marriott hotel brands?

- Why Do Hotel Companies Have So Many Brands?

- Marriott Bonvoy’s 30 Different Hotel Brands

- The Ultimate Guide to The World’s Top Hotel Brands and Their Properties

- An In-Depth Guide to All 29 Marriott Hotel Brands

- Marriott Hotels Brand Portfolio

- Marriott Hotels: An Overview of Brands in the USA Capital Region

- The 9 Best Intercontinental Hotels of 2021

- The 8 Best Hyatt Resorts of 2021

- The 9 Best Hilton Hotels of 2021

- All 30 Marriott Brands, Ranked From Worst to First

- How Marriott Breaks Down Their 30 Brands

- Full list of Marriott hotel brands

- Hotel Brands: Who Owns What?

- Top 10 Largest Hotel Chains in the World

- 32 Marriott Bonvoy Hotel Brands

- 7 Accor Hotel Brands

- BOOTHS VS BANQUETTES: WHAT’S THE DIFFERENCE?

- Choosing Booth Seating In Your Restaurant

- STUDENT ACCOMMODATION – FURNISHED OR UNFURNISHED?

- Hospitality Furniture Buying Guide: Where do US hotels buy their furniture from?

- How to create engaging custom hotel furniture

- How to style hotel interiors in 2021

- Hotel Trends of The Future

- How to pick the right outdoor furniture for your environment

- How to select bar furniture for your hospitality venue

- Everything You Need to Know About Hotel Interior Design

- What Is an Extended Stay Hotel?

- What Is a Boutique Hotel?

- A Guide to 21 of the Most Popular Types of Hotels

- Types of Hotel Rooms

- Five Most important Materials in Hotel Furniture Industry

- How to Maintain Hotel Furniture for 10+ Years

- 3 and 4 Star Budget-Friendly Hotel Guest Room Designs

- 7 Things to Consider Whilst Designing a Restaurant Furniture Layout

- What type of restaurant chair should you prefer – wooden, metal, or plastic?

- What Type of Guestroom Furniture Should You Prefer?

- How To Choose The Best Hotel Bedroom Furniture?

- Comprehensive Guide On How To Choose The Best Lobby Furniture

- What are luxury hotels?

- Choosing the Best Furniture for Your Hotel or Guest House

- 5 hotel lobby design tips and why you should rethink yours

- HOSPITALITY TRENDS FOR 2021 YOU NEED TO KNOW

- 3 Reasons You Need a Restaurant Furniture Expert

- 5 Ways to Compare Restaurant Tables and Chairs

- 5 Hotel Ergonomics & Furniture Design Trends for Post-COVID 2022

- HOW TO PURCHASE THE RIGHT FURNITURE FOR YOUR RESTAURANT

- Restaurant interior design trends

- What is OS&E?

- What is the difference between FF&E purchasing and FF&E procurement?

- What is the difference between FF&E purchasing and FF&E sourcing?

- What does the FF&E procurement process look like?

- How do you account for FF&E in a hotel project?

- What is a reserve FF&E budget?

- What are the benefits of using an FF&E Consultant?

- What is FF&E documentation and specification?

- What is FF&E procurement?

- FF&E Procurement Explained

- Things You Need to Know Before Choosing Your FF&E Procurement Provider

- ALL ABOUT FF&E PROCUREMENT

- What Does an FF&E Procurement Provider Do?

- 10 Must Consider Points in Procuring Furniture for Boutique Hotel

- How Hotels Can Find Right FF&E Procurement Partner To Elevate Hotel Brand Value?

- 12 Aspects to Consider for Successful Renovation of Hotels

- 10 Tips For Setting Up Your Motels

- 4 Point Formula for Deciding Best Hospitality Procurement Organization

- Know The Best Decorating Tips For Arranging Hotels

- Hospitality Industry Challenges Addressed by Procurement Vendor

- Best Sofa Style for 2021

- Impact of COVID-19 on Procurement Hospitality Shipment Industry

- Hospitality Furniture Supplier Trends to Watch Over!

- Getting The Correct Hotel Design

- The Future of Hospitality FF&E Purchasing

- When to Hire an FF&E Purchasing Agent

- Creating an Accurate Preliminary Budget for Your Hotel

- The Future of Hospitality Design – A Conversation

- The Core of FF&E and OS&E Procurement – Part 1: Preliminary Budget Creation

- The Core of FF&E and OS&E Procurement – Part 2: The FF&E Procurement Process

- The Core of FF&E and OS&E Procurement – Part 3: Choosing a Purchasing Agent

- How to pick outdoor furniture for your hospitality venue

- 9 Essential Restaurant Design Tips

- How To Choose The Ultimate Hospitality Furniture?

- How to Choose the Best Sectional Sofa for Your Hotel?

- How to Identify Best Hospitality Furniture for Your Dream Hotel & Home?

- Where do US hotels buy their furniture from?

- What do hotels do with used furniture?

- Where and how do interior designers buy furniture for clients?

- When to transform your Hotel's Interior?

- Benefits of choosing a luxury leather lounge chair

- How to create custom furniture you’ll love

- Sofa Styles for the Hospitality Industry

- Art of Hospitality Design

- How should restaurant table tops be cleaned in the COVID-19 era?

- WHAT IS CONTRACT FURNITURE

- WHAT’S IN A CONTRACT DINING CHAIR?

- RESTAURANT MAINTENANCE – WHAT ARE YOUR OPTIONS?

- SENIOR LIVING AMENITIES: DESIGNING SPACES TO PROMOTE COMMUNITY ENGAGEMENT

- The Hospitality Industry Welcomes More Sustainable Furniture

- LET’S TALK SENIOR LIVING FURNITURE

- MULTIFAMILY AMENITIES AND SERVICES: THE CONTACTLESS AGE

- What is furniture, fixtures, and equipment (FF&E)? Definition and examples

- What is FF&E in Construction

- Hospitality FF&E

- 5 WAYS TO FIND THE PERFECT FF&E FREIGHT PROVIDER

- The 4 Best Ways to Receive Freight for Furniture Delivery

- 3 Ways Hiring an Inexperienced FF&E Installation Company Will Ruin Your Hotel Launch

- Top Tips for FF&E Procurement

- FF&E Logistics Company: Your FF&E Pro

- HOW FF&E FIRMS CAN GENERATE MORE HOTEL SALES LEADS

- TOP 7 HOSPITALITY DESIGN TRENDS THAT WILL MATTER IN 2021

- Using an Independent FF&E Consultant rather than a Furniture Supplier

- The FF&E Process Explained

- What is the Interior designer FF&E full job role

- How is the interior Architect designer job is a basic in facilities management

- FF&E: A Complete Guide

- What is FF&E and Why Does it Affect my Building Project?

- What is Furniture, Fixtures, and Equipment (FF&E)?

- FF&E Construction: What is it? Why does it matter?

- How To Avoid Hotel FF&E Delays From Chinese New Year

- DO I NEED AN INTERIOR DESIGNER OR AN FF&E DESIGNER?

- HOW MUCH TO BUDGET FOR FF&E?

- WHO SHOULD BE CONSIDERING FF&E SERVICES?

- HIDDEN CHALLENGES IN FF&E AND HOW TO TACKLE THEM

- WHAT IS MODERN LUXURY INTERIOR DESIGN?

- THE IMPORTANCE OF HAVING SPECIALIST CONSULTANTS ASSISTING ACROSS YOUR LUXURY INTERIOR DESIGN PROJECT

- 2021 INTERIOR DESIGN TRENDS

- ALL ABOUT FF&E PROCUREMENT

- HOW TO PROJECT MANAGE A HOUSE RENOVATION

- BEGINNERS GUIDE TO INTERIOR DESIGN

- WHAT DOES INTERIOR DESIGN MANAGEMENT INVOLVE?

- SMART HOME TECHNOLOGY & STYLE – CAN THEY CO-EXIST?

- DESIGNED FROM INSIDE OUT: WHY ARCHITECTS SHOULD LET INTERIOR DESIGNERS TAKE THE LEAD WHEN IT COMES TO FUNCTIONALITY

- FF&E PROCUREMENT SERVICES: WHAT THEY CAN DO FOR YOU

- Comfort Hotels Rise & Shine™ FF&E

- 4 Key Factors for You to Choose the Right Hotel Room Furniture

- How Much Does Hotel Furniture Cost in Hotel Construction

- Never Underestimate the Influence of Hotel Furniture Layout

- Top 3 Reasons Why You Should Invest in Custom Hotel Furniture

- The Best Guest Room Design: Keys to Make Guests Always Feel Welcome

- Top 4 Types of Hotel Furniture veneer

- Top 5 of the Best Modern Hotel Furniture Design Trend in 2021

- Expert Guide to Know About Wall Cladding in A Commercial Building

- The Complete Guide to Hotel FF&E Procurement Process and Stages

- How to Manage FF&E Budget in Hotel Construction Project?

- What is Hotel Renovation and How to Renovate a Hotel?

- How Are Gen Z and Millennials Influencing Trends in the Hospitality Industry

- What is FF&E for a Hotel & Why is it Important

- How to Choose a Reliable Hotel Furniture Supplier

- 4 Reasons Why You Need Luxury Hotel Furniture

- 6 Ways to Manage and Reduce Hotel FF&E Costs With FF&E Procurement

- What Kinds of Modern Hotel Furniture Should a Hotel Have?

- What Your Choice in Hotel Furniture Says about Your Hotel Style

- Three Ways to Improve Hotel Guest Experience

- Ascend Hotel Collection FF&E

- Cambria Hotels FF&E

- Points to Know the Different Types of Custom Fixed Furniture and Their Advantages

- Top 5 Ideal Raw Materials for Furniture Making

- What does a senior soft outfit designer for hospitality industry do?

- What does a lead FF&E design manager do?

- Quality Inn FF&E

- Sleep Inn FF&E

- Clarion Inn FF&E

- MainStay Suites FF&E

- Suburban Extended Stay Hotel FF&E

- WoodSpring Suites FF&E

- Econo Lodge FF&E

- Rodeway Inn FF&E

- Best Western FF&E

- Americas Best Value Inn FF&E

- Hotel RL FF&E

- Red Lion Inn & Suites FF&E

- Signature Inn FF&E

- Canadas Best Value Inn FF&E

- Country Inn & Suites FF&E

- Drury Inn & Suites FF&E

- Pear Tree Inn FF&E

- Motel 6 & Studio 6 FF&E

- Loews Hotels FF&E

- Shilo Inns Suites FF&E

- Microtel Inn & Suites FF&E

- Days Inn FF&E

- Super 8 FF&E

- Howard Johnson FF&E

- Travelodge FF&E

- Hawthorn Suites FF&E

- AmericInn FF&E

- Baymont Inn & Suites FF&E

- La Quinta Inn & Suites FF&E

- Ramada FF&E

- Trademark Collection FF&E

- Wingate FF&E

- Wyndham Garden FF&E

- Hoteliers Worry High Rates and Reduced Services Spark Backlash from Guests

- Hotel Executive Commentary Highlights Busy Third Quarter for Transactions

- Set Expectations with Hotel Capital Expenditures

- Hilton, Marriott Chief Executives Prepare for Industry's Next Cycle

- Special CapEx Considerations for the COVID-19 Era

- Host Hotels & Resorts Encouraged by Business Transient Demand Uptick

- Boutique Hotels Balance Connections, Experiences and Safety

- Return of Leisure, Business Demand Reaccelerate Recovery for Pebblebrook

- How To Master Sourcing and Procurement For Interior Design?

- How To Create An Interior Designer Resume?

- How to design a custom sofa to fit your space

- How To Keep Hotel Lobby Furniture Modern

- Commercial Lobby Furniture: Comfortable Furniture For Your Hotel

- How to Choose the Best Sectional Sofa for Your Hotel

- How to Identify Best Hospitality Furniture for Your Dream Hotel & Home

- Brands To Push for Renovations as US Hotels Recover

- Five Things to Consider Before your New Office Fit-Out

- How to Complete a Restaurant Renovation

- Top 5 Tips for a Seamless Hotel Fitout

- Alt-Normal: Some Prospects for Hotels Post-Pandemic

- HOTEL LOBBIES: WHAT LOOKS GOOD?

- How to Customize Your Interiors While Maintaining Timelines and Budget

- How to Choose Workstations in Guestroom and Public Areas

- The Importance of a Hotel FF&E Reserve Revealed

- Hotel FF&E Installation and Manufacturing: A Winning Combination

- How to Build an Eco-Friendly Hotel with Green FF&E

- Elements to Consider When Designing Bespoke Hotel Furniture

- The Difference Between Bespoke and Custom Hospitality Furniture

- "FF&E" is a major that 80% of Chinese interior designers do not know

- What Is Industrial Look Like On Furniture

- What Are Carbon Neutrality And The Trend Of Aluminum Furniture

- How to Organize Your Room: 5 Tips for Organizing Your Room

- Guide to Bathtub Sizes: 8 Common Types of Bathtubs

- 9 Tips for Decorating a Hallway: How to Decorate a Hallway

- What Is Velvet? A Guide to the Different Types of Velvet

- 8 House Décor Ideas and Tips: How to Decorate a Home

- Small Space Interior Design: 6 Ways to Maximize Small Homes

- How to Decorate a Large Wall: 4 Simple Wall Décor Ideas

- Victorian Interior Design: 6 Design Elements of Victorian Style

- Hotel Executives Expect Business Travel To 'Roar Back' in 2022

- Tips on hotel reception furniture design

- 8 super tips on hotel room furniture design

- Your Quick Guide to Choosing China Hotel Furniture Suppliers

- High End Hotel Furniture Manufacturers in China

- Simple Overview of Hotel Furniture China Price

- Charming Hotel Furniture Foshan

- Hotel Furniture from China

- Hotel furniture in China

- Guide to Choose Hotel Furniture Suppliers China

- A Comprehensive Guide to Furniture Factory in China

- Hotel Bedroom Furniture Manufacturers China

- Hotel furniture for Sale in China

- Why opt for hotel furniture made in China

- An overview of hotel furniture china manufacturers

- Hotel Room Furniture Manufacturers in China

- Trends in Hotel Furniture China

- How to Buy Hotel Furniture

- A Complete Guide about Importing Hotel Furniture from China

- Canopy by Hilton FF&E

- Conrad Hotels FF&E

- Curio Collection FF&E

- DoubleTree FF&E

- Embassy Suites FF&E

- Hampton Inn FF&E

- Hilton Garden Inn FF&E

- Hilton Grand Vacations FF&E

- Hilton FF&E

- Home2 Suites FF&E

- Homewood Suites FF&E

- Motto by Hilton FF&E

- Signia by Hilton FF&E

- Tapestry Collection by Hilton FF&E

- Tru by Hilton FF&E

- Tempo by Hilton FF&E

- Waldorf Astoria FF&E

- Atwell Suites FF&E

- Avid Hotels FF&E

- Candlewood Suites FF&E

- Crowne Plaza FF&E

- EVEN Hotels FF&E

- Holiday Inn Club Vacations FF&E

- Holiday Inn Express FF&E

- Holiday Inn FF&E

- Hotel Indigo FF&E

- HUALUXE FF&E

- InterContinental FF&E

- Kimpton Hotels FF&E

- Regent Hotels FF&E

- Staybridge Suites FF&E

- voco Hotels FF&E

- AC Hotels FF&E

- Aloft Hotels FF&E

- Autograph Collection FF&E

- Bulgari Hotels FF&E

- Courtyard by Marriott FF&E

- Delta Hotels FF&E

- Design Hotels FF&E

- EDITION Hotels FF&E

- Element by Westin FF&E

- Fairfield Inn FF&E

- Four Points by Sheraton FF&E

- Gaylord Hotels FF&E

- Homes & Villas FF&E

- JW Marriott FF&E

- Le Meridien FF&E

- The Luxury Collection FF&E

- Marriott Executive Apartments FF&E

- Marriott Hotels & Resorts FF&E

- Marriott Vacation Club FF&E

- Moxy Hotels FF&E

- Protea Hotels FF&E

- Renaissance FF&E

- Residence Inn FF&E

- Ritz-Carlton FF&E

- Sheraton FF&E

- SpringHill Suites FF&E

- St. Regis FF&E

- TownePlace Suites FF&E

- Tribute Portfolio FF&E

- W Hotels FF&E

- Westin Hotels FF&E

- 3 Top Reasons Restaurant Booth Seating is So Popular

- Tips to Choose the Right Furniture for Your Restaurant

- 12 Travel Industry Trends That Hoteliers Need To Be Aware Of For 2022

- 5 Ways Hotels Are Creating Positive Sustainable Change

- 8 Travel Industry Trends For 2021

- What is hotel channel management?

- 12 Impressive Hospitality Trends To Watch In 2022

- Hotel general managers reveal their key strategies amid huge workloads

- 7 hospitality industry trends to watch in 2022

- What Percentage of Hotel Construction Costs Should Go to Furniture

- Supplier vs. Vendor: what's the difference

- How to Choose Furniture for Your Restaurant

- How to Choose Restaurant Equipment for a Wine Bar

- Hotels upgrade bathrooms for more demanding guests

- 12 Simple Tips on How to Make Your Bathroom Look More Like a Luxury Hotel

- Creating a luxury bathroom: how to make your bathroom feel like a luxury five-star hotel

- Top Concerns and Trends for Hoteliers in 2021

- FF&E: How the Movers can Help You throughout the Moving Process

- What You Need to Know About Hotel FF&E Installation

- Why should you hire an FF&E Specialist

- Top 10 Best Kitchen Cabinets Ideas

- How to Choose the Right Outdoor Wood Furniture

- 8 Considerations: What to Look for in Bed in a Box Mattresses

- 8 Benefits of Replacing Your Windows

- Hard Cost vs Soft Cost – All You Need to Know

- What to Consider when Buying High End Outdoor Furniture

- When is The Best Time of Year to Buy Furniture and Where Should I Look

- Packing and Shipping Furniture Across USA

- Why Choose Metal Chairs for Your Restaurant

- How to Match Right Commercial Furniture with Your Restaurant Style

- How to Decide Number of Table Tops for Your Restaurant

- Complete Guide For Making Hotel Furniture Designs More Eco-Friendly

- Complete Guide: Things To Know Before Buying Bar Stools

- Hoteliers Redefine Flexibility To Meet Labor Challenges

- Hotel Development Environment Improves, but Hurdles Remain

- How Selling Strategies Have Evolved for Hotels

- Hoteliers in Europe Hope To Benefit from Growing Appetite for Cross-Border Travel

- How Hoteliers Have Adapted to the Industry's Labor Shortage

- A Look at US and Hotel Employment Data in 2021

- Hotel Industry Recovery Hinges on Demand from Business Travelers, Groups

- Caribbean Hotel Recovery Relies on US Travelers Amid Stricter Travel Rules Elsewhere

- Hotel Occupancy a Headwind for Hospitality Employment in Southern US Markets

- The Difference Between 'Hospitality' and 'Guest Service'

- What Has Changed in the Hospitality Industry

- The Lost Year: How COVID-19 Has Altered the Hotel Industry

- Detailed overview of Custom furniture from China

- Custom furniture manufacturer in China

- Custom Made Furniture China: Find your new furniture piece today

- Super tips on design hotel furniture design

- Bestar: A professional team Hotel furniture modern design

- Interior design hotel furniture: what you need to know

- Top tips on furniture hotel counter design

- 10 tips on modern hotel furniture design

- Ten things you should consider in hotel furniture and design

- A Ultimate Guide to Hospitality Furniture and Design

- Hotel Furniture Design: A Beautiful Way to Stay

- 8 steps to Custom made furniture in China

- How Do Hotel Star Ratings Actually Work

- HOTEL STAR RATING SYSTEMS MEANING - STAR RATINGS EXPLAINED

- How Are Hotels Star Rated

- Hotel star ratings explained

- How to find the best location for your restaurant

- 10 Most Popular Types Of Restaurants

- Benefits of wooden furniture in your space

- How To Select Cast Iron Table Bases for Your Restaurant

- 14 Ways Procure Hospitality Improves Efficacy of Hospitality Procurement Process

- Hotel Furniture Procurement Guide

- How much does Restaurant Furniture Cost

- Designing A Restaurant Table And Booth Combination

- Try These 3 Window Treatments To Reduce Cooling Or Heating Cost

- The 5 most common problems you may come across with your Club Furniture

- Solid Wood Dining Table Buying Skills

- How To Buy A Coffee Table

- What Types Of Solid Wood Dining Tables Are There

- What Are The Advantages Of Sofa Beds

- What Is The Best Material For The Dining Table

- How To Maintain The Solid Wood Dining Table

- What Are The Pros And Cons Of A Small Dining Table

- How To Maintain The Solid Wood Table

- The Sofa Takes Care Of Our Spine Health

- Choosing Sofa Fabric

- What Is The Significance Of The Sofa In The Living Room

- How To Choose A Coffee Table

- What Is The Process Of Customizing A Home

- Why Does The Wardrobe Affect The Aura Of The Bedroom

- Why Do Light-Colored Wardrobes Bring Bright Spaces

- Custom Furniture To Control Material Costs

- What Are The Unique Advantages Of Solid Wood Furniture Customization

- What Should Be Paid Attention To When Customizing Solid Wood Furniture

- What Are The Advantages Of Whole House Custom Furniture

- What Is Whole House Custom Furniture

- Beware Of Price Traps When Customizing Furniture

- How To Prevent Yellowing Of White Furniture

- Do You Know The Common Wood In Solid Wood Furniture

- What Are The Differences Between Eastern And Western Furniture Production Processes

- Several Mistakes Should Be Paid Attention To When Cleaning Furniture

- Office Furniture Odor Removal Tips

- So How To Choose A Sofa

- How To Deal With The Wear And Tear Of Furniture

- How To Maintain And Clean The Leather Sofa

- High-Value Light Luxury Dining Chair

- Sofa Style

- Sofas Are Classified By Function

- How To Maintain The Fabric Sofa

- What Does A Good Leather Sofa Look Like

- How About The Leather Soft Bed

- How About The Leather Soft Bed

- Tips For Cleaning The Sofa Here

- How To Buy A Fabric Sofa That You Like

- Summer Home Replacement Sofa Cover Purchase Coup

- Light Luxury Dining Chair Home Fabric Stainless Steel Dining Stool Chair

- 10 Living Room-Dining Room Combos

- How To Identify Leather Sofa

- How To Put The Sofa In The Living Room

- 7 Basic But Brilliant Home Decorating Styles

- Illuminates The Dining Space

- Luxury Custom-Made Furniture: How to Personalize It

- Sofa Styles for the Hospitality Industry

- Why Your Vacation Rental Needs a Sleeper Sofa

- Hotel Lobby Furniture - How To Choose

- 4 key considerations for hotel furniture

- Custom Solid Wood Bookcases, Be Sure To Pay Attention To These Points

- Are modular lounges better

- multifunctional luxury spaces

- Design Concept And Layout Of Coffee Table

- How To Choose A Sofa

- What are the advantages of hotel suite furniture

- how should the size of the luggage rack be determined

- Take you to understand the characteristics and advantages of hotel furniture

- What are the advantages of solid wood dining chairs

- Dining chair maintenance

- How a Caring Culture and Proactive Practices Support the Growth of a Family-Run Hotel Management Company

- Springhill Suites by Marriott in Chula Vista Begins Construction

- Delta Hotels by Marriott Opens 100th Property

- Best practice procurement process in the Interior Design industry

- Hotel Operators Face Thorny Choices for 2023 Budgeting

- Grand Cayman Marriott Beach Resort Completes $16M Reno

- Add A Metal Coffee Table To Your Home Decor

- Choosing A Dining Table

- How To Craft A Luxury Interior Design In 2023

- Contemporary Vs. Modern Interiors

- Crafting Your Dream Luxury Interior Design

- Important Considerations In Luxury Interior Design

- Luxury Interior Design: Everything That You Need To Know

- Luxury Furniture Designs For Apartment

- What Are The Advantages Of Wooden Bedroom Furniture

- Advantages Of Living Room Sofa

- What is Sustainable Hospitality Furniture

- Specifying Cane Contract Furniture - What You Need to Know

- All about Stacking Chairs

- The four characteristics of a hotel furniture design

- Popular materials for luxury hotel furniture manufacture

- How to choose headboards for your hotel

- Characteristics of a Custom Hotel Furniture

- Four ways to maintain hotel room storage

- 4 Tips for Furnishing your Restaurant

- Advantages of Custom Hotel Furniture

- What are the Basic Furniture Required to Set Up a Hotel

- What factors will affect hotel furniture prices

- 7 signs your that hotel needs renovation

- A good hotel furniture manufacturer

- How Often Do Hotels Change Their Interiors

- How to make a hotel room feel like home

- How to make better Furniture for hotel lobby

- Tips for maintaining hotel furniture

- How do we choose the qualified wood for solid wood furniture

- What is the difference between loose furniture and fixed furniture

- 10 Tips for Choosing the Perfect Furniture for Your Pub/Bar

- Custom Furniture: All You Need to Know

- Outdoor Furniture for Your Restaurant’s

- How to Make Your Restaurant Look Luxurious

- Ways to Protect Restaurant Outdoor Furniture during the Winter

- 10 things to consider before buying a sofa

- This festive season, give your hotel a new makeover with luxury furniture!

- What Standards to keep in mind when choosing furniture for your restaurant

- Outdoor Furniture for Restaurants to Instantly Impress the Guests

- Why customising furniture is becoming the new trend?

- Choose Restaurant Bar Stools that fit your space perfectly

- 10 Restaurant and Café Furniture Ideas!

- Few Mistakes To Avoid While Choosing Restaurant Furniture

- How colour psychology impacts the selection of furniture

- Sofa Bed Reason To Buy

- Restaurant Furniture Ideas

- Interior Design Trends 2023: luxury, custom and sustainability

- Bed Buying Guide: Upholstered vs Wooden vs Metal Bed Frame

- How To Style Dresser: Tips & Tricks You Should Consider

- Trendy Wardrobe Design Ideas For Bedroom

- Renovating the Right Way: Ensuring Projects Succeed While Protecting the Guest Experience

- How To Arrange The Coffee Table At Home

- What Are The Problems When Using Coffee Table

- Luxury Hotel Room Key Concepts

- 5 Things to Look For In Quality Restaurant Pub Tables

- Choosing The Right Furniture For Hotels

- Commercial Interior Design: Rules For A Successful Project

- Outdoor Sectional Furniture Buying Guide 2023

- Hotel furniture moisture-proof knowledge

- Tips for choosing lighting in hotel restaurant area

- How to maintain the hotel dinning table

- A simple Hotel suite furniture quality check tutorial

- Important things you need to consider when choosing hotel furniture

- Tips for custom made hotel furniture

- What are the advantages of five-star hotel furniture customization

- Designing Your Dining Room

- Furniture & Furnishing Industry in Hong Kong

- Bar Stools vs Counter Stools: Finding the Perfect Fit for Your Restaurant

- What’s New in Outdoor Seating Ideas for Restaurants?

- Blog

- Blog

- Contact

Travelers Plan Activities Farther Ahead, Extend Booking Window

For the European hotel industry to fully emerge from the COVID-19 era of lockdowns and waffling demand, travel to and from international markets must resume unhindered.

With variants causing COVID cases rise again, that scenario is unlikely anytime soon, but a better bet for hoteliers eager for guests is the demand from cross-border travelers, who are equally eager to hit the roads.

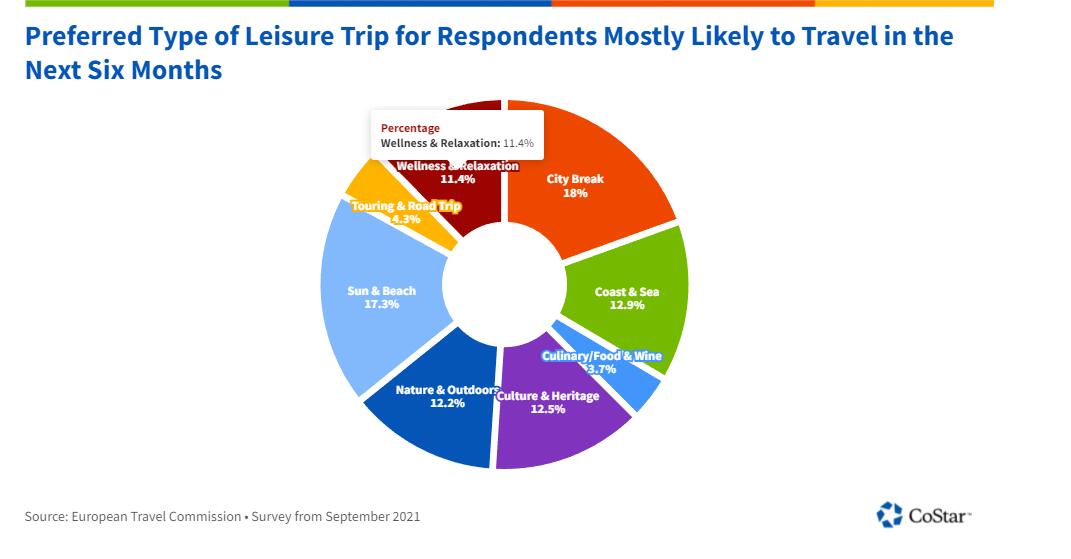

Eduardo Santander, executive director at the Brussels-based European Travel Commission, said surveys conducted by his organization show that one in two European travelers are planning trips to other European countries, a 41% increase since September 2020. The latest survey was conducted in the third quarter of 2021.

These trips are shorter in length, but average daily spending on travel is up, he said. Staycations also have decreased in number by 18% over the past 12 months as travelers look farther afield.

“Intra-regional travel in Europe has experienced a significant uplift this year. It is set to account for 85% of European international arrivals in 2021, up from 77% in 2019,” he said.

Standardized requirements for proof of vaccination around the continent could help to make travel between the 44 countries in Europe, 27 of which are in the European Union and the closely associated European Economic Area, more seamless.

The EU’s COVID-19 passport and the United Kingdom’s National Health Service passports are being accepted as proof of vaccination, but industry experts said for many, travel has the stigma of being overly complicated and unsafe.

Dimitrios Buhalis, visiting professor with the School of Hospitality & Tourism Management at The Hong Kong Polytechnic University, said vaccinations have given travelers optimism, although it remains to be seen how the new variant might damper that sentiment over the winter holiday.

“What you saw over the summer is infections going down, along with the optimism that vaccinations gave us, and we saw most countries have more or less opened their borders," he said.

He said he has noticed more appetite for short-haul and domestic travel in Europe.

“Greece did well, where the risk was fairly well managed, and most of Greece is outdoors,” he said of his native country. “But there is no appetite to be on a plane for five hours or so to travel to places where you cannot trust the health systems can sustain any pressure.”

He added Greece on Nov. 30 imposed a fine of €100 ($113) a month for those age 60 and above who refuse to be vaccinated, the justification being to relieve pressure on national health services.

Buhalis added that on the plus side for developing countries there is more space and less crowding.

With variants causing COVID cases rise again, that scenario is unlikely anytime soon, but a better bet for hoteliers eager for guests is the demand from cross-border travelers, who are equally eager to hit the roads.

Eduardo Santander, executive director at the Brussels-based European Travel Commission, said surveys conducted by his organization show that one in two European travelers are planning trips to other European countries, a 41% increase since September 2020. The latest survey was conducted in the third quarter of 2021.

These trips are shorter in length, but average daily spending on travel is up, he said. Staycations also have decreased in number by 18% over the past 12 months as travelers look farther afield.

“Intra-regional travel in Europe has experienced a significant uplift this year. It is set to account for 85% of European international arrivals in 2021, up from 77% in 2019,” he said.

Standardized requirements for proof of vaccination around the continent could help to make travel between the 44 countries in Europe, 27 of which are in the European Union and the closely associated European Economic Area, more seamless.

The EU’s COVID-19 passport and the United Kingdom’s National Health Service passports are being accepted as proof of vaccination, but industry experts said for many, travel has the stigma of being overly complicated and unsafe.

Dimitrios Buhalis, visiting professor with the School of Hospitality & Tourism Management at The Hong Kong Polytechnic University, said vaccinations have given travelers optimism, although it remains to be seen how the new variant might damper that sentiment over the winter holiday.

“What you saw over the summer is infections going down, along with the optimism that vaccinations gave us, and we saw most countries have more or less opened their borders," he said.

He said he has noticed more appetite for short-haul and domestic travel in Europe.

“Greece did well, where the risk was fairly well managed, and most of Greece is outdoors,” he said of his native country. “But there is no appetite to be on a plane for five hours or so to travel to places where you cannot trust the health systems can sustain any pressure.”

He added Greece on Nov. 30 imposed a fine of €100 ($113) a month for those age 60 and above who refuse to be vaccinated, the justification being to relieve pressure on national health services.

Buhalis added that on the plus side for developing countries there is more space and less crowding.

Under Pressure

At November’s Annual Hotel Conference in Manchester, Stephen Cassidy, senior vice president and managing director for the U.K., Ireland and Israel at Hilton, said hoteliers remain anxious.

“We are looking at two big variables, how the top-line performs and the labor environment recovers … and how quickly will international markets return. Domestic continues to be strong, higher than 2019 levels, and we are seeing pent-up desire to come back to the U.K., which demand for is in rude health,” he said.

Such demand has led to increased hotel supply, though some of that new construction was signed and financed before the start of the pandemic.

Tom Emanuel, director at STR, CoStar’s hospitality analytics firm, said the U.K. is the largest beneficiary of increased supply, even if demand is heavily skewed to domestic travelers in the short term.

“The pipeline in the U.K. is significantly more than in any other European country, and by quite a high margin — approximately 140,000 keys, compared with approximately 100,000 in Germany,” he said.

He added if every hotel in the pipeline opens, supply in London will increase by 25% and in Liverpool by 54%.

Added to this, Emanuel said travelers are slightly less worried about the likelihood and potential hassle and cost of quarantine.

Santander and Buhalis said digitization is playing a major role in this new era of travel.

“Digitalization has moved 10 years ahead … in location matching,” Buhalis said.

“There are applications for tourism flow, perhaps to show people what part of the beach is, what the weather might be so you can decide if not to go because you might be forced indoors,” he added.

Santander said technology has been instrumental in changing the nature of travel.

At November’s Annual Hotel Conference in Manchester, Stephen Cassidy, senior vice president and managing director for the U.K., Ireland and Israel at Hilton, said hoteliers remain anxious.

“We are looking at two big variables, how the top-line performs and the labor environment recovers … and how quickly will international markets return. Domestic continues to be strong, higher than 2019 levels, and we are seeing pent-up desire to come back to the U.K., which demand for is in rude health,” he said.

Such demand has led to increased hotel supply, though some of that new construction was signed and financed before the start of the pandemic.

Tom Emanuel, director at STR, CoStar’s hospitality analytics firm, said the U.K. is the largest beneficiary of increased supply, even if demand is heavily skewed to domestic travelers in the short term.

“The pipeline in the U.K. is significantly more than in any other European country, and by quite a high margin — approximately 140,000 keys, compared with approximately 100,000 in Germany,” he said.

He added if every hotel in the pipeline opens, supply in London will increase by 25% and in Liverpool by 54%.

Added to this, Emanuel said travelers are slightly less worried about the likelihood and potential hassle and cost of quarantine.

Santander and Buhalis said digitization is playing a major role in this new era of travel.

“Digitalization has moved 10 years ahead … in location matching,” Buhalis said.

“There are applications for tourism flow, perhaps to show people what part of the beach is, what the weather might be so you can decide if not to go because you might be forced indoors,” he added.

Santander said technology has been instrumental in changing the nature of travel.

“We have seen a lot of last-minute travel, with 29% of those who had travel plans in October and November booking those trips in September," he said.

He added this dropped further, to 15%, among those traveling later in 2021.

“Formerly to get the best deal they booked far earlier ... but the [average] cost of a city break of three nights is getting lower,” he added.

He said the shortening of trips has affected budgets, with the percentage of travelers intending to spend up to €500 ($566) on their trips growing by 20% compared to the ETC’s previous survey as higher expenditure levels of €1,000 or more decrease.

Santander added that the preference for booking a branded hotel now is at its highest level since September 2020, likely due to flexible cancellation policies and the brand companies' work around health and hygiene.

He said in the coming months travelers are most confident about travel to Poland, Spain, Italy, the Netherlands and Germany.

"Looking at the destinations, Mediterranean countries rank highest on travelers’ destination wish lists, with Spain and Italy, France and Greece as the top preferences," he said.

He added this dropped further, to 15%, among those traveling later in 2021.

“Formerly to get the best deal they booked far earlier ... but the [average] cost of a city break of three nights is getting lower,” he added.

He said the shortening of trips has affected budgets, with the percentage of travelers intending to spend up to €500 ($566) on their trips growing by 20% compared to the ETC’s previous survey as higher expenditure levels of €1,000 or more decrease.

Santander added that the preference for booking a branded hotel now is at its highest level since September 2020, likely due to flexible cancellation policies and the brand companies' work around health and hygiene.

He said in the coming months travelers are most confident about travel to Poland, Spain, Italy, the Netherlands and Germany.

"Looking at the destinations, Mediterranean countries rank highest on travelers’ destination wish lists, with Spain and Italy, France and Greece as the top preferences," he said.

Greece Gains

The ETC's Santander agreed with Buhalis aboute the rebound of Greece's tourism industry.

“As the first nation to reopen its borders to COVID-free tourists, Greece delivered the strongest rebound in overnight terms,” and lags 2019 numbers only by 19%, Santander said.

“The strongest pick-up in arrivals from 2019 rates was observed in Croatia, which was able to extend its outstanding performance off-season welcoming 1.9 million tourist arrivals in September. Montenegro, Luxembourg and Monaco also saw a modest pick-up in arrivals,” he said.

Still, Buhalis said he has no doubt this winter will be tough.

“A lot of people will die over Christmas, and there are still a lot of people who refuse to understand the seriousness of the situation. Gradually, little by little, vaccinations, deaths and infections will get us to a certain degree of herd immunity,” he said.

Santander said in Europe he was optimistic for Christmas and New Year’s.

“It will not be like it was. Nothing will look the same ever again, but we see guests very much looking for safe [hotel] bookings. Loyal customers are reviewing the quality of service, and rates are charging up. It is hard to find a room for a decent price,” he said.

Santander’s plea is for governments in Europe and elsewhere to continue to find common solutions, a degree of harmonization and an agreement to accept all vaccinations approved by the World Health Organization.

He said he does not expect a return to 2019 levels until 2024.

“Our research forecasts European international tourist arrivals to be 60% below 2019 levels by the end of 2021. However, successful vaccine programs should permit further easing and facilitate travel in 2022, supporting a return to pre-crisis levels by 2024,” Santander said.

“Omicron is not the last variant. What we want to avoid is a blanket travel ban. Europe does have the ability to limit outbreaks, and more booster vaccinations will help,” he said.

“We also had seen a rise in business travel, but that was before omicron. It will not disappear, and group travel will come back, but it will be different. We live in an age of change in risk management, climate change and digitalization,” he added.

The ETC's Santander agreed with Buhalis aboute the rebound of Greece's tourism industry.

“As the first nation to reopen its borders to COVID-free tourists, Greece delivered the strongest rebound in overnight terms,” and lags 2019 numbers only by 19%, Santander said.

“The strongest pick-up in arrivals from 2019 rates was observed in Croatia, which was able to extend its outstanding performance off-season welcoming 1.9 million tourist arrivals in September. Montenegro, Luxembourg and Monaco also saw a modest pick-up in arrivals,” he said.

Still, Buhalis said he has no doubt this winter will be tough.

“A lot of people will die over Christmas, and there are still a lot of people who refuse to understand the seriousness of the situation. Gradually, little by little, vaccinations, deaths and infections will get us to a certain degree of herd immunity,” he said.

Santander said in Europe he was optimistic for Christmas and New Year’s.

“It will not be like it was. Nothing will look the same ever again, but we see guests very much looking for safe [hotel] bookings. Loyal customers are reviewing the quality of service, and rates are charging up. It is hard to find a room for a decent price,” he said.

Santander’s plea is for governments in Europe and elsewhere to continue to find common solutions, a degree of harmonization and an agreement to accept all vaccinations approved by the World Health Organization.

He said he does not expect a return to 2019 levels until 2024.

“Our research forecasts European international tourist arrivals to be 60% below 2019 levels by the end of 2021. However, successful vaccine programs should permit further easing and facilitate travel in 2022, supporting a return to pre-crisis levels by 2024,” Santander said.

“Omicron is not the last variant. What we want to avoid is a blanket travel ban. Europe does have the ability to limit outbreaks, and more booster vaccinations will help,” he said.

“We also had seen a rise in business travel, but that was before omicron. It will not disappear, and group travel will come back, but it will be different. We live in an age of change in risk management, climate change and digitalization,” he added.

- Home

- About Us

-

Hotel Furniture

- Contract Furniture

- AC Hotel Furniture

- Aloft Hotel Furniture

- AmericInn & Suites Furniture

- Andaz Hyatt Hotel Furniture

- Autograph Collection Hotel Furniture

- Avid Hotel Furniture

- Baymont Inn & Suites Furniture

- Best Western Hotel Furniture

- Candlewood Suites Furniture

- Canopy by Hilton Furniture

- Clarion Hotel Furniture

- Clarion Inn Furniture

- Comfort Inn & Suites Rise & Shine™ Furniture

- Conrad Hotel Furniture

- Country Inn & Suites Furniture

- Courtyard by Marriott Furniture

- Crowne Plaza Hotel Furniture

- Curio Collection By Hilton Hotel Furniture

- Days Inn Furniture

- Delta Hotel By Marriott Furniture

- DoubleTree by Hilton Hotel Furniture

- Econo Lodge Furniture

- Edition Hotel Furniture

- Element By Westin Furniture

- Embassy Suites by Hilton Furniture

- EVEN Hotels By IHG Furniture

- Fairfield Inn & Suites Furniture

- Fairmont Hotel Furniture

- Four Points By Sheraton Furniture

- Gaylord Hotel By Marriott Furniture

- Grand Hyatt Hotel Furniture

- Grand Mercure Hotel Furniture

- Hampton Inn Furniture

- Hilton Garden Inn Furniture

- Holiday Inn Express Furniture

- Holiday Inn Furniture

- Home2 Suites Furniture

- Homewood Suites Furniture

- Hotel Indigo Furniture

- Hyatt Centric Furniture

- Hyatt Hotel Furniture

- Hyatt House Hotel Furniture

- Hyatt Place Furniture

- Hyatt Regency Furniture

- Ibis Hotel Furniture

- Jumeirah Furniture

- JW Marriott Furniture

- La Quinta Inn & Suites Furniture

- Le Meridien Hotel Furniture

- Mainstay Suites Furniture

- Mercure Hotel Furniture

- Microtel Inn & Suites Furniture

- Motel 6 & Studio 6 Furniture

- Motto by Hilton Furniture

- Movenpick Hotel Furniture

- Novotel Hotel Furniture

- Park Hyatt Furniture

- Park Inn by Radisson Furniture

- Premier Inn Hotel Furniture

- Pullman Hotel Furniture

- Quality Inn & Suites Furniture

- Radisson Blu Furniture

- Radisson Park Plaza Furniture

- Raffles Hotel Furniture

- Ramada Hotel Furniture

- Red Roof Inn Furniture

- Renaissance Hotel Furniture

- Residence Inn Furniture

- Ritz Carlton Hotel Furniture

- Rodeway Inn & Suites Furniture

- Sheraton Hotel Furniture

- Sleep Inn Furniture

- Howard Johnson Hotel Furniture

- Sofitel Hotel Furniture

- SpringHill Suites Furniture

- St Regis Hotel Furniture

- Staybridge Suites Furniture

- Super 8 Furniture

- Swissotel Furniture

- Travelodge Inn & Suites Furniture

- Tribute Portfolio Hotel Furniture

- Tru by Hilton Furniture

- W Hotels Marriott Furniture

- Waldorf Astoria Furniture

- Westin Hotels & Resorts Furniture

- Wingate by Wyndham Furniture

- WoodSpring Suites Furniture

- Wyndham Garden Furniture

- Budget Hotel Furniture

- Accommodation Furniture

- Restaurant Furniture

-

Blog

- WHAT IS HOSPITALITY FURNITURE

- What Is Hospitality Interior Design?

- What is FF&E?

- What is FF&E and OS&E?

- 18 Hilton Hotel Brands

- Your Guide to Hilton Honors Hotel Brands

- All 18 Hilton Hotel Brands Explained & Prices Compared

- An In-Depth Guide to All 18 Hilton Hotel Brands

- 14 Choice Hotel Brands

- 18 Best Western Hotel Brands

- 23 Wyndham Hotel Brands

- 19 Hyatt Hotel Brands

- What Are IHG Hotel Brands?

- 16 IHG Hotels & Resorts Brands

- Hotel Brands: Marriott, Hyatt, Hilton, IHG (Who Owns What?)

- What are Marriott hotel brands?

- Why Do Hotel Companies Have So Many Brands?

- Marriott Bonvoy’s 30 Different Hotel Brands

- The Ultimate Guide to The World’s Top Hotel Brands and Their Properties

- An In-Depth Guide to All 29 Marriott Hotel Brands

- Marriott Hotels Brand Portfolio

- Marriott Hotels: An Overview of Brands in the USA Capital Region

- The 9 Best Intercontinental Hotels of 2021

- The 8 Best Hyatt Resorts of 2021

- The 9 Best Hilton Hotels of 2021

- All 30 Marriott Brands, Ranked From Worst to First

- How Marriott Breaks Down Their 30 Brands

- Full list of Marriott hotel brands

- Hotel Brands: Who Owns What?

- Top 10 Largest Hotel Chains in the World

- 32 Marriott Bonvoy Hotel Brands

- 7 Accor Hotel Brands

- BOOTHS VS BANQUETTES: WHAT’S THE DIFFERENCE?

- Choosing Booth Seating In Your Restaurant

- STUDENT ACCOMMODATION – FURNISHED OR UNFURNISHED?

- Hospitality Furniture Buying Guide: Where do US hotels buy their furniture from?

- How to create engaging custom hotel furniture

- How to style hotel interiors in 2021

- Hotel Trends of The Future

- How to pick the right outdoor furniture for your environment

- How to select bar furniture for your hospitality venue

- Everything You Need to Know About Hotel Interior Design

- What Is an Extended Stay Hotel?

- What Is a Boutique Hotel?

- A Guide to 21 of the Most Popular Types of Hotels

- Types of Hotel Rooms

- Five Most important Materials in Hotel Furniture Industry

- How to Maintain Hotel Furniture for 10+ Years

- 3 and 4 Star Budget-Friendly Hotel Guest Room Designs

- 7 Things to Consider Whilst Designing a Restaurant Furniture Layout

- What type of restaurant chair should you prefer – wooden, metal, or plastic?

- What Type of Guestroom Furniture Should You Prefer?

- How To Choose The Best Hotel Bedroom Furniture?

- Comprehensive Guide On How To Choose The Best Lobby Furniture

- What are luxury hotels?

- Choosing the Best Furniture for Your Hotel or Guest House

- 5 hotel lobby design tips and why you should rethink yours

- HOSPITALITY TRENDS FOR 2021 YOU NEED TO KNOW

- 3 Reasons You Need a Restaurant Furniture Expert

- 5 Ways to Compare Restaurant Tables and Chairs

- 5 Hotel Ergonomics & Furniture Design Trends for Post-COVID 2022

- HOW TO PURCHASE THE RIGHT FURNITURE FOR YOUR RESTAURANT

- Restaurant interior design trends

- What is OS&E?

- What is the difference between FF&E purchasing and FF&E procurement?

- What is the difference between FF&E purchasing and FF&E sourcing?

- What does the FF&E procurement process look like?

- How do you account for FF&E in a hotel project?

- What is a reserve FF&E budget?

- What are the benefits of using an FF&E Consultant?

- What is FF&E documentation and specification?

- What is FF&E procurement?

- FF&E Procurement Explained

- Things You Need to Know Before Choosing Your FF&E Procurement Provider

- ALL ABOUT FF&E PROCUREMENT

- What Does an FF&E Procurement Provider Do?

- 10 Must Consider Points in Procuring Furniture for Boutique Hotel

- How Hotels Can Find Right FF&E Procurement Partner To Elevate Hotel Brand Value?

- 12 Aspects to Consider for Successful Renovation of Hotels

- 10 Tips For Setting Up Your Motels

- 4 Point Formula for Deciding Best Hospitality Procurement Organization

- Know The Best Decorating Tips For Arranging Hotels

- Hospitality Industry Challenges Addressed by Procurement Vendor

- Best Sofa Style for 2021

- Impact of COVID-19 on Procurement Hospitality Shipment Industry

- Hospitality Furniture Supplier Trends to Watch Over!

- Getting The Correct Hotel Design

- The Future of Hospitality FF&E Purchasing

- When to Hire an FF&E Purchasing Agent

- Creating an Accurate Preliminary Budget for Your Hotel

- The Future of Hospitality Design – A Conversation

- The Core of FF&E and OS&E Procurement – Part 1: Preliminary Budget Creation

- The Core of FF&E and OS&E Procurement – Part 2: The FF&E Procurement Process

- The Core of FF&E and OS&E Procurement – Part 3: Choosing a Purchasing Agent

- How to pick outdoor furniture for your hospitality venue

- 9 Essential Restaurant Design Tips

- How To Choose The Ultimate Hospitality Furniture?

- How to Choose the Best Sectional Sofa for Your Hotel?

- How to Identify Best Hospitality Furniture for Your Dream Hotel & Home?

- Where do US hotels buy their furniture from?

- What do hotels do with used furniture?

- Where and how do interior designers buy furniture for clients?

- When to transform your Hotel's Interior?

- Benefits of choosing a luxury leather lounge chair

- How to create custom furniture you’ll love

- Sofa Styles for the Hospitality Industry

- Art of Hospitality Design

- How should restaurant table tops be cleaned in the COVID-19 era?

- WHAT IS CONTRACT FURNITURE

- WHAT’S IN A CONTRACT DINING CHAIR?

- RESTAURANT MAINTENANCE – WHAT ARE YOUR OPTIONS?

- SENIOR LIVING AMENITIES: DESIGNING SPACES TO PROMOTE COMMUNITY ENGAGEMENT

- The Hospitality Industry Welcomes More Sustainable Furniture

- LET’S TALK SENIOR LIVING FURNITURE

- MULTIFAMILY AMENITIES AND SERVICES: THE CONTACTLESS AGE

- What is furniture, fixtures, and equipment (FF&E)? Definition and examples

- What is FF&E in Construction

- Hospitality FF&E

- 5 WAYS TO FIND THE PERFECT FF&E FREIGHT PROVIDER

- The 4 Best Ways to Receive Freight for Furniture Delivery

- 3 Ways Hiring an Inexperienced FF&E Installation Company Will Ruin Your Hotel Launch

- Top Tips for FF&E Procurement

- FF&E Logistics Company: Your FF&E Pro

- HOW FF&E FIRMS CAN GENERATE MORE HOTEL SALES LEADS

- TOP 7 HOSPITALITY DESIGN TRENDS THAT WILL MATTER IN 2021

- Using an Independent FF&E Consultant rather than a Furniture Supplier

- The FF&E Process Explained

- What is the Interior designer FF&E full job role

- How is the interior Architect designer job is a basic in facilities management

- FF&E: A Complete Guide

- What is FF&E and Why Does it Affect my Building Project?

- What is Furniture, Fixtures, and Equipment (FF&E)?

- FF&E Construction: What is it? Why does it matter?

- How To Avoid Hotel FF&E Delays From Chinese New Year

- DO I NEED AN INTERIOR DESIGNER OR AN FF&E DESIGNER?

- HOW MUCH TO BUDGET FOR FF&E?

- WHO SHOULD BE CONSIDERING FF&E SERVICES?

- HIDDEN CHALLENGES IN FF&E AND HOW TO TACKLE THEM

- WHAT IS MODERN LUXURY INTERIOR DESIGN?

- THE IMPORTANCE OF HAVING SPECIALIST CONSULTANTS ASSISTING ACROSS YOUR LUXURY INTERIOR DESIGN PROJECT

- 2021 INTERIOR DESIGN TRENDS

- ALL ABOUT FF&E PROCUREMENT

- HOW TO PROJECT MANAGE A HOUSE RENOVATION

- BEGINNERS GUIDE TO INTERIOR DESIGN

- WHAT DOES INTERIOR DESIGN MANAGEMENT INVOLVE?

- SMART HOME TECHNOLOGY & STYLE – CAN THEY CO-EXIST?

- DESIGNED FROM INSIDE OUT: WHY ARCHITECTS SHOULD LET INTERIOR DESIGNERS TAKE THE LEAD WHEN IT COMES TO FUNCTIONALITY

- FF&E PROCUREMENT SERVICES: WHAT THEY CAN DO FOR YOU

- Comfort Hotels Rise & Shine™ FF&E

- 4 Key Factors for You to Choose the Right Hotel Room Furniture

- How Much Does Hotel Furniture Cost in Hotel Construction

- Never Underestimate the Influence of Hotel Furniture Layout

- Top 3 Reasons Why You Should Invest in Custom Hotel Furniture

- The Best Guest Room Design: Keys to Make Guests Always Feel Welcome

- Top 4 Types of Hotel Furniture veneer

- Top 5 of the Best Modern Hotel Furniture Design Trend in 2021

- Expert Guide to Know About Wall Cladding in A Commercial Building

- The Complete Guide to Hotel FF&E Procurement Process and Stages

- How to Manage FF&E Budget in Hotel Construction Project?

- What is Hotel Renovation and How to Renovate a Hotel?

- How Are Gen Z and Millennials Influencing Trends in the Hospitality Industry

- What is FF&E for a Hotel & Why is it Important

- How to Choose a Reliable Hotel Furniture Supplier

- 4 Reasons Why You Need Luxury Hotel Furniture

- 6 Ways to Manage and Reduce Hotel FF&E Costs With FF&E Procurement

- What Kinds of Modern Hotel Furniture Should a Hotel Have?

- What Your Choice in Hotel Furniture Says about Your Hotel Style

- Three Ways to Improve Hotel Guest Experience

- Ascend Hotel Collection FF&E

- Cambria Hotels FF&E

- Points to Know the Different Types of Custom Fixed Furniture and Their Advantages

- Top 5 Ideal Raw Materials for Furniture Making

- What does a senior soft outfit designer for hospitality industry do?

- What does a lead FF&E design manager do?

- Quality Inn FF&E

- Sleep Inn FF&E

- Clarion Inn FF&E

- MainStay Suites FF&E

- Suburban Extended Stay Hotel FF&E

- WoodSpring Suites FF&E

- Econo Lodge FF&E

- Rodeway Inn FF&E

- Best Western FF&E

- Americas Best Value Inn FF&E

- Hotel RL FF&E

- Red Lion Inn & Suites FF&E

- Signature Inn FF&E

- Canadas Best Value Inn FF&E

- Country Inn & Suites FF&E

- Drury Inn & Suites FF&E

- Pear Tree Inn FF&E

- Motel 6 & Studio 6 FF&E

- Loews Hotels FF&E

- Shilo Inns Suites FF&E

- Microtel Inn & Suites FF&E

- Days Inn FF&E

- Super 8 FF&E

- Howard Johnson FF&E

- Travelodge FF&E

- Hawthorn Suites FF&E

- AmericInn FF&E

- Baymont Inn & Suites FF&E

- La Quinta Inn & Suites FF&E

- Ramada FF&E

- Trademark Collection FF&E

- Wingate FF&E

- Wyndham Garden FF&E

- Hoteliers Worry High Rates and Reduced Services Spark Backlash from Guests

- Hotel Executive Commentary Highlights Busy Third Quarter for Transactions

- Set Expectations with Hotel Capital Expenditures

- Hilton, Marriott Chief Executives Prepare for Industry's Next Cycle

- Special CapEx Considerations for the COVID-19 Era

- Host Hotels & Resorts Encouraged by Business Transient Demand Uptick

- Boutique Hotels Balance Connections, Experiences and Safety

- Return of Leisure, Business Demand Reaccelerate Recovery for Pebblebrook

- How To Master Sourcing and Procurement For Interior Design?

- How To Create An Interior Designer Resume?

- How to design a custom sofa to fit your space

- How To Keep Hotel Lobby Furniture Modern

- Commercial Lobby Furniture: Comfortable Furniture For Your Hotel

- How to Choose the Best Sectional Sofa for Your Hotel

- How to Identify Best Hospitality Furniture for Your Dream Hotel & Home

- Brands To Push for Renovations as US Hotels Recover

- Five Things to Consider Before your New Office Fit-Out

- How to Complete a Restaurant Renovation

- Top 5 Tips for a Seamless Hotel Fitout

- Alt-Normal: Some Prospects for Hotels Post-Pandemic

- HOTEL LOBBIES: WHAT LOOKS GOOD?

- How to Customize Your Interiors While Maintaining Timelines and Budget

- How to Choose Workstations in Guestroom and Public Areas

- The Importance of a Hotel FF&E Reserve Revealed

- Hotel FF&E Installation and Manufacturing: A Winning Combination

- How to Build an Eco-Friendly Hotel with Green FF&E

- Elements to Consider When Designing Bespoke Hotel Furniture

- The Difference Between Bespoke and Custom Hospitality Furniture

- "FF&E" is a major that 80% of Chinese interior designers do not know

- What Is Industrial Look Like On Furniture

- What Are Carbon Neutrality And The Trend Of Aluminum Furniture

- How to Organize Your Room: 5 Tips for Organizing Your Room

- Guide to Bathtub Sizes: 8 Common Types of Bathtubs

- 9 Tips for Decorating a Hallway: How to Decorate a Hallway

- What Is Velvet? A Guide to the Different Types of Velvet

- 8 House Décor Ideas and Tips: How to Decorate a Home

- Small Space Interior Design: 6 Ways to Maximize Small Homes

- How to Decorate a Large Wall: 4 Simple Wall Décor Ideas

- Victorian Interior Design: 6 Design Elements of Victorian Style

- Hotel Executives Expect Business Travel To 'Roar Back' in 2022

- Tips on hotel reception furniture design

- 8 super tips on hotel room furniture design

- Your Quick Guide to Choosing China Hotel Furniture Suppliers

- High End Hotel Furniture Manufacturers in China

- Simple Overview of Hotel Furniture China Price

- Charming Hotel Furniture Foshan

- Hotel Furniture from China

- Hotel furniture in China

- Guide to Choose Hotel Furniture Suppliers China

- A Comprehensive Guide to Furniture Factory in China

- Hotel Bedroom Furniture Manufacturers China

- Hotel furniture for Sale in China

- Why opt for hotel furniture made in China

- An overview of hotel furniture china manufacturers

- Hotel Room Furniture Manufacturers in China

- Trends in Hotel Furniture China

- How to Buy Hotel Furniture

- A Complete Guide about Importing Hotel Furniture from China

- Canopy by Hilton FF&E

- Conrad Hotels FF&E

- Curio Collection FF&E

- DoubleTree FF&E

- Embassy Suites FF&E

- Hampton Inn FF&E

- Hilton Garden Inn FF&E

- Hilton Grand Vacations FF&E

- Hilton FF&E

- Home2 Suites FF&E

- Homewood Suites FF&E

- Motto by Hilton FF&E

- Signia by Hilton FF&E

- Tapestry Collection by Hilton FF&E

- Tru by Hilton FF&E

- Tempo by Hilton FF&E

- Waldorf Astoria FF&E

- Atwell Suites FF&E

- Avid Hotels FF&E

- Candlewood Suites FF&E

- Crowne Plaza FF&E

- EVEN Hotels FF&E

- Holiday Inn Club Vacations FF&E

- Holiday Inn Express FF&E

- Holiday Inn FF&E

- Hotel Indigo FF&E

- HUALUXE FF&E

- InterContinental FF&E

- Kimpton Hotels FF&E

- Regent Hotels FF&E

- Staybridge Suites FF&E

- voco Hotels FF&E

- AC Hotels FF&E

- Aloft Hotels FF&E

- Autograph Collection FF&E

- Bulgari Hotels FF&E

- Courtyard by Marriott FF&E

- Delta Hotels FF&E

- Design Hotels FF&E

- EDITION Hotels FF&E

- Element by Westin FF&E

- Fairfield Inn FF&E

- Four Points by Sheraton FF&E

- Gaylord Hotels FF&E

- Homes & Villas FF&E

- JW Marriott FF&E

- Le Meridien FF&E

- The Luxury Collection FF&E

- Marriott Executive Apartments FF&E

- Marriott Hotels & Resorts FF&E

- Marriott Vacation Club FF&E

- Moxy Hotels FF&E

- Protea Hotels FF&E

- Renaissance FF&E

- Residence Inn FF&E

- Ritz-Carlton FF&E

- Sheraton FF&E

- SpringHill Suites FF&E

- St. Regis FF&E

- TownePlace Suites FF&E

- Tribute Portfolio FF&E

- W Hotels FF&E

- Westin Hotels FF&E

- 3 Top Reasons Restaurant Booth Seating is So Popular

- Tips to Choose the Right Furniture for Your Restaurant

- 12 Travel Industry Trends That Hoteliers Need To Be Aware Of For 2022

- 5 Ways Hotels Are Creating Positive Sustainable Change

- 8 Travel Industry Trends For 2021

- What is hotel channel management?

- 12 Impressive Hospitality Trends To Watch In 2022

- Hotel general managers reveal their key strategies amid huge workloads

- 7 hospitality industry trends to watch in 2022

- What Percentage of Hotel Construction Costs Should Go to Furniture

- Supplier vs. Vendor: what's the difference

- How to Choose Furniture for Your Restaurant

- How to Choose Restaurant Equipment for a Wine Bar

- Hotels upgrade bathrooms for more demanding guests

- 12 Simple Tips on How to Make Your Bathroom Look More Like a Luxury Hotel

- Creating a luxury bathroom: how to make your bathroom feel like a luxury five-star hotel

- Top Concerns and Trends for Hoteliers in 2021

- FF&E: How the Movers can Help You throughout the Moving Process

- What You Need to Know About Hotel FF&E Installation

- Why should you hire an FF&E Specialist

- Top 10 Best Kitchen Cabinets Ideas

- How to Choose the Right Outdoor Wood Furniture

- 8 Considerations: What to Look for in Bed in a Box Mattresses

- 8 Benefits of Replacing Your Windows

- Hard Cost vs Soft Cost – All You Need to Know

- What to Consider when Buying High End Outdoor Furniture

- When is The Best Time of Year to Buy Furniture and Where Should I Look

- Packing and Shipping Furniture Across USA

- Why Choose Metal Chairs for Your Restaurant

- How to Match Right Commercial Furniture with Your Restaurant Style

- How to Decide Number of Table Tops for Your Restaurant

- Complete Guide For Making Hotel Furniture Designs More Eco-Friendly

- Complete Guide: Things To Know Before Buying Bar Stools

- Hoteliers Redefine Flexibility To Meet Labor Challenges

- Hotel Development Environment Improves, but Hurdles Remain

- How Selling Strategies Have Evolved for Hotels

- Hoteliers in Europe Hope To Benefit from Growing Appetite for Cross-Border Travel

- How Hoteliers Have Adapted to the Industry's Labor Shortage

- A Look at US and Hotel Employment Data in 2021

- Hotel Industry Recovery Hinges on Demand from Business Travelers, Groups

- Caribbean Hotel Recovery Relies on US Travelers Amid Stricter Travel Rules Elsewhere

- Hotel Occupancy a Headwind for Hospitality Employment in Southern US Markets

- The Difference Between 'Hospitality' and 'Guest Service'

- What Has Changed in the Hospitality Industry

- The Lost Year: How COVID-19 Has Altered the Hotel Industry

- Detailed overview of Custom furniture from China

- Custom furniture manufacturer in China

- Custom Made Furniture China: Find your new furniture piece today

- Super tips on design hotel furniture design

- Bestar: A professional team Hotel furniture modern design

- Interior design hotel furniture: what you need to know

- Top tips on furniture hotel counter design

- 10 tips on modern hotel furniture design

- Ten things you should consider in hotel furniture and design

- A Ultimate Guide to Hospitality Furniture and Design

- Hotel Furniture Design: A Beautiful Way to Stay

- 8 steps to Custom made furniture in China

- How Do Hotel Star Ratings Actually Work

- HOTEL STAR RATING SYSTEMS MEANING - STAR RATINGS EXPLAINED

- How Are Hotels Star Rated

- Hotel star ratings explained

- How to find the best location for your restaurant

- 10 Most Popular Types Of Restaurants

- Benefits of wooden furniture in your space

- How To Select Cast Iron Table Bases for Your Restaurant

- 14 Ways Procure Hospitality Improves Efficacy of Hospitality Procurement Process

- Hotel Furniture Procurement Guide

- How much does Restaurant Furniture Cost

- Designing A Restaurant Table And Booth Combination

- Try These 3 Window Treatments To Reduce Cooling Or Heating Cost

- The 5 most common problems you may come across with your Club Furniture

- Solid Wood Dining Table Buying Skills

- How To Buy A Coffee Table

- What Types Of Solid Wood Dining Tables Are There

- What Are The Advantages Of Sofa Beds

- What Is The Best Material For The Dining Table

- How To Maintain The Solid Wood Dining Table

- What Are The Pros And Cons Of A Small Dining Table

- How To Maintain The Solid Wood Table

- The Sofa Takes Care Of Our Spine Health

- Choosing Sofa Fabric

- What Is The Significance Of The Sofa In The Living Room

- How To Choose A Coffee Table

- What Is The Process Of Customizing A Home

- Why Does The Wardrobe Affect The Aura Of The Bedroom

- Why Do Light-Colored Wardrobes Bring Bright Spaces

- Custom Furniture To Control Material Costs

- What Are The Unique Advantages Of Solid Wood Furniture Customization

- What Should Be Paid Attention To When Customizing Solid Wood Furniture

- What Are The Advantages Of Whole House Custom Furniture

- What Is Whole House Custom Furniture

- Beware Of Price Traps When Customizing Furniture

- How To Prevent Yellowing Of White Furniture

- Do You Know The Common Wood In Solid Wood Furniture

- What Are The Differences Between Eastern And Western Furniture Production Processes

- Several Mistakes Should Be Paid Attention To When Cleaning Furniture

- Office Furniture Odor Removal Tips

- So How To Choose A Sofa

- How To Deal With The Wear And Tear Of Furniture

- How To Maintain And Clean The Leather Sofa

- High-Value Light Luxury Dining Chair

- Sofa Style

- Sofas Are Classified By Function

- How To Maintain The Fabric Sofa

- What Does A Good Leather Sofa Look Like

- How About The Leather Soft Bed

- How About The Leather Soft Bed

- Tips For Cleaning The Sofa Here

- How To Buy A Fabric Sofa That You Like

- Summer Home Replacement Sofa Cover Purchase Coup

- Light Luxury Dining Chair Home Fabric Stainless Steel Dining Stool Chair

- 10 Living Room-Dining Room Combos

- How To Identify Leather Sofa

- How To Put The Sofa In The Living Room

- 7 Basic But Brilliant Home Decorating Styles

- Illuminates The Dining Space

- Luxury Custom-Made Furniture: How to Personalize It

- Sofa Styles for the Hospitality Industry

- Why Your Vacation Rental Needs a Sleeper Sofa

- Hotel Lobby Furniture - How To Choose

- 4 key considerations for hotel furniture

- Custom Solid Wood Bookcases, Be Sure To Pay Attention To These Points

- Are modular lounges better

- multifunctional luxury spaces

- Design Concept And Layout Of Coffee Table

- How To Choose A Sofa

- What are the advantages of hotel suite furniture

- how should the size of the luggage rack be determined

- Take you to understand the characteristics and advantages of hotel furniture

- What are the advantages of solid wood dining chairs

- Dining chair maintenance

- How a Caring Culture and Proactive Practices Support the Growth of a Family-Run Hotel Management Company

- Springhill Suites by Marriott in Chula Vista Begins Construction

- Delta Hotels by Marriott Opens 100th Property

- Best practice procurement process in the Interior Design industry

- Hotel Operators Face Thorny Choices for 2023 Budgeting

- Grand Cayman Marriott Beach Resort Completes $16M Reno

- Add A Metal Coffee Table To Your Home Decor

- Choosing A Dining Table

- How To Craft A Luxury Interior Design In 2023

- Contemporary Vs. Modern Interiors

- Crafting Your Dream Luxury Interior Design

- Important Considerations In Luxury Interior Design

- Luxury Interior Design: Everything That You Need To Know

- Luxury Furniture Designs For Apartment

- What Are The Advantages Of Wooden Bedroom Furniture

- Advantages Of Living Room Sofa

- What is Sustainable Hospitality Furniture

- Specifying Cane Contract Furniture - What You Need to Know

- All about Stacking Chairs

- The four characteristics of a hotel furniture design

- Popular materials for luxury hotel furniture manufacture

- How to choose headboards for your hotel

- Characteristics of a Custom Hotel Furniture

- Four ways to maintain hotel room storage

- 4 Tips for Furnishing your Restaurant

- Advantages of Custom Hotel Furniture

- What are the Basic Furniture Required to Set Up a Hotel

- What factors will affect hotel furniture prices

- 7 signs your that hotel needs renovation

- A good hotel furniture manufacturer

- How Often Do Hotels Change Their Interiors

- How to make a hotel room feel like home

- How to make better Furniture for hotel lobby

- Tips for maintaining hotel furniture

- How do we choose the qualified wood for solid wood furniture

- What is the difference between loose furniture and fixed furniture

- 10 Tips for Choosing the Perfect Furniture for Your Pub/Bar

- Custom Furniture: All You Need to Know

- Outdoor Furniture for Your Restaurant’s

- How to Make Your Restaurant Look Luxurious

- Ways to Protect Restaurant Outdoor Furniture during the Winter

- 10 things to consider before buying a sofa

- This festive season, give your hotel a new makeover with luxury furniture!

- What Standards to keep in mind when choosing furniture for your restaurant

- Outdoor Furniture for Restaurants to Instantly Impress the Guests

- Why customising furniture is becoming the new trend?

- Choose Restaurant Bar Stools that fit your space perfectly

- 10 Restaurant and Café Furniture Ideas!

- Few Mistakes To Avoid While Choosing Restaurant Furniture

- How colour psychology impacts the selection of furniture

- Sofa Bed Reason To Buy

- Restaurant Furniture Ideas

- Interior Design Trends 2023: luxury, custom and sustainability

- Bed Buying Guide: Upholstered vs Wooden vs Metal Bed Frame

- How To Style Dresser: Tips & Tricks You Should Consider

- Trendy Wardrobe Design Ideas For Bedroom

- Renovating the Right Way: Ensuring Projects Succeed While Protecting the Guest Experience

- How To Arrange The Coffee Table At Home

- What Are The Problems When Using Coffee Table

- Luxury Hotel Room Key Concepts

- 5 Things to Look For In Quality Restaurant Pub Tables

- Choosing The Right Furniture For Hotels

- Commercial Interior Design: Rules For A Successful Project

- Outdoor Sectional Furniture Buying Guide 2023

- Hotel furniture moisture-proof knowledge

- Tips for choosing lighting in hotel restaurant area

- How to maintain the hotel dinning table

- A simple Hotel suite furniture quality check tutorial

- Important things you need to consider when choosing hotel furniture

- Tips for custom made hotel furniture

- What are the advantages of five-star hotel furniture customization

- Designing Your Dining Room

- Furniture & Furnishing Industry in Hong Kong

- Bar Stools vs Counter Stools: Finding the Perfect Fit for Your Restaurant

- What’s New in Outdoor Seating Ideas for Restaurants?

- Blog

- Blog

- Contact